Neto

I recently gave a talk at Parliament in Canberra on the topic of the Future of Retail, and I wanted to share some of the core ideas with you.

In a world where consumers are hyper-connected, the need to be sales channel agnostic is more relevant than ever. It is now common for a customer to be shopping in your store, use their mobile phone to compare a product of yours online, have their questions answered by a virtual assistant or chatbot, and have purchased the product from a competitor before they’ve even stepped outside of your doors.

Yet although consumers are spending more time online, and more money online, this does not spell the demise of bricks and mortar retail. After all, online retail accounts for less than 10% of total retail spend in this country and less than 15% in the US. Instead, online retail opens up a whole world of opportunity to retailers of all shapes and sizes.

Recently we surveyed over 1,000 active online shoppers with Telstra, and analysed the transaction data of over 1,000 Neto merchants for our Neto State of Ecommerce Report, and what we found is that consumer habits are changing and the retailers who are adapting to these changes are the ones who are winning.

Here's what you need to know.

An overarching theme throughout the findings was the importance of ease and convenience at every stage of the buying journey, from product research through to shipping, returns and refunds.

In fact, 82% of shoppers surveyed cited ease and convenience as the most important reason to shop online.

In the past 12 months we have really seen this demand for a frictionless experience drive change throughout the industry, none more so than in the payments and shipping space.

We are also seeing a change in the rate at which both retailers and consumers adopt new technologies. Transaction volumes through the still relatively new Buy Now, Pay Later payment methods like Afterpay and ZipMoney have grown by a staggering 147% this year—a nod to the instant gratification-centric nature of consumers, as well as openness to new technologies. Similarly, the willingness of merchants to adopt new technologies that will allow them to boost business or offer choice and differentiation at checkout is also on the rise. Going back not even three years, it would take months for merchants to adopt a new feature in the Neto platform, now, we see mass adoption within days of release.

In the shipping and fulfillment spaces we are also seeing a great deal of innovation, much of which, I believe can be attributed to the launch of Amazon Australia. Services like Australia Post’s Shipster—where shoppers pay a membership fee for access to discounted and priority shipping—are designed to help Australian retailers compete against Amazon’s equivalent service, Amazon Prime (although we still have no word yet on when Prime will launch in Australia).

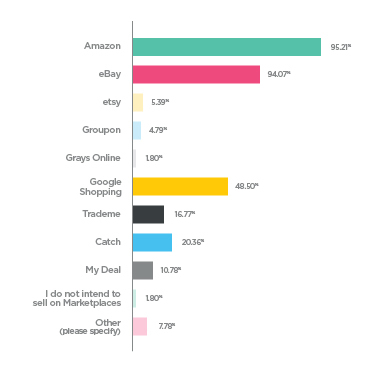

Our research found that sentiment towards Amazon Australia is positive among both consumers and retailers alike. In our survey of online shoppers in July 2017, 1 in 3 said they intended to switch to Amazon when it launches, and in a survey of Neto retailers that coincided with the Australian soft launch of Amazon, 96% said they intended to sell on Amazon in 2018.

Technology adoption and in particular, development, is not without cost. But with Marketplaces like eBay and Amazon dominating the online retail landscape here in Australia and abroad, there is an opportunity for retailers and wholesalers to partner or integrate with these bigger players to leverage their rapid advances in technology as well as their loyal customers.

For example, through eBay, retailers can now tap into voice technology in people's homes with products like Google Home and Amazon's Alex, where customers can order products directly via voice commands.

For established retailers the challenge is leveraging these sales channels without cannibalising their existing operations. For small businesses and startups, it’s an exciting opportunity to grow big, fast. After all, household names such as Catch of the Day and Kogan got their start on eBay and I think there will be similar success stories that come out of Amazon.

| Related Reading: 95% of retailers to sell on Amazon and other Marketplaces in 2018 [New data]

Regardless of one's intention to leverage channels like Amazon, to survive and compete both locally and abroad, retailers need to invest early in technology that enables them to seamlessly surface their inventory wherever their customers are. Australian Retailers that are stuck in legacy systems, that are not sales channel agnostic, will find it increasingly hard to adapt quickly and compete both locally and abroad. It is therefore our responsibility to ensure that services like Neto are accessible, affordable and ready for whatever the next Amazon is.

12 years ago, Neto CEO, Ryan Murtagh, started his journey as an Australian multi-channel retailer, importing and distributing products on eBay, a webstore and a bricks and mortar location. Leading Australian retail management platform, Neto, was built to solve the problems he and many other retailers experienced in running an omni-channel retail business. Today, Neto provides a complete solution for ecommerce, POS, inventory, and fulfilment, enabling thousands of Australian retailers and wholesalers to thrive in what is an ever changing retail landscape.

Looking for an ecommerce platform that will take your business into the future? Download our free guide: Choosing your ecommerce platform to make sure you're asking the right questions.