The ecommerce industry is evolving before our eyes. Businesses are pivoting, capabilities are growing, and companies are exploring new ways to reach more clients, audiences, and markets.

One sector that’s been instrumental in facilitating this shift is the fintech industry. There’s been an enormous amount of growth from this field, and the capacity on offer for businesses is as exciting as it’s ever been.

So let’s take a closer look at how these companies can help your business grow.

What is fintech?

Fintech is simply financial technology. These businesses, like Airwallex, provide innovative tech products and services that support you in your banking and finance.

Airwallex is an Australian fintech that’s helping to grow the digital economy. And as Australia’s fastest-growing cross-border payment provider, we provide businesses with a suite of tools designed with your growth in mind.

Banking for a new generation of business

The rise of fintech can be seen as a challenge to the traditional banking model. The online nature of these organisations means an effective reduction in the space between businesses and customers, allowing for more agility in the way businesses operate.

Think about it. You can now interact with businesses and suppliers all over the globe. You can purchase goods from suppliers in Sydney, Seoul, or Sacramento, with the only real difference—besides currency—being the time it takes to arrive at your door.

This shrinking in global distances has seen a growth in the market share and size available to businesses.

How fintechs are helping grow ecommerce businesses

With the ability to look much further afield, and build relationships with international partners, you’re able to reach a wider market of more niche audiences, and target more specific customer segments in these offerings.

They can help:

Streamline your imports and international expenses

Leveraging this connected world wouldn’t be possible without fintech. Now, you can connect with and engage international importers at the click of a button. Currency is no longer a barrier to foreign imports and exports, nor are bank fees.

With Airwallex, your funds are transferred directly through local bank networks, with most payments being received on the same day. This means you can make international payments without international lag. Better yet, we offer near-wholesale foreign exchange rates without any hidden fees or margins that the major banks add.

With an integration into Xero, managing all international payments and reconciliations will be a breeze. Your accountant will thank you for that.

Access international customers

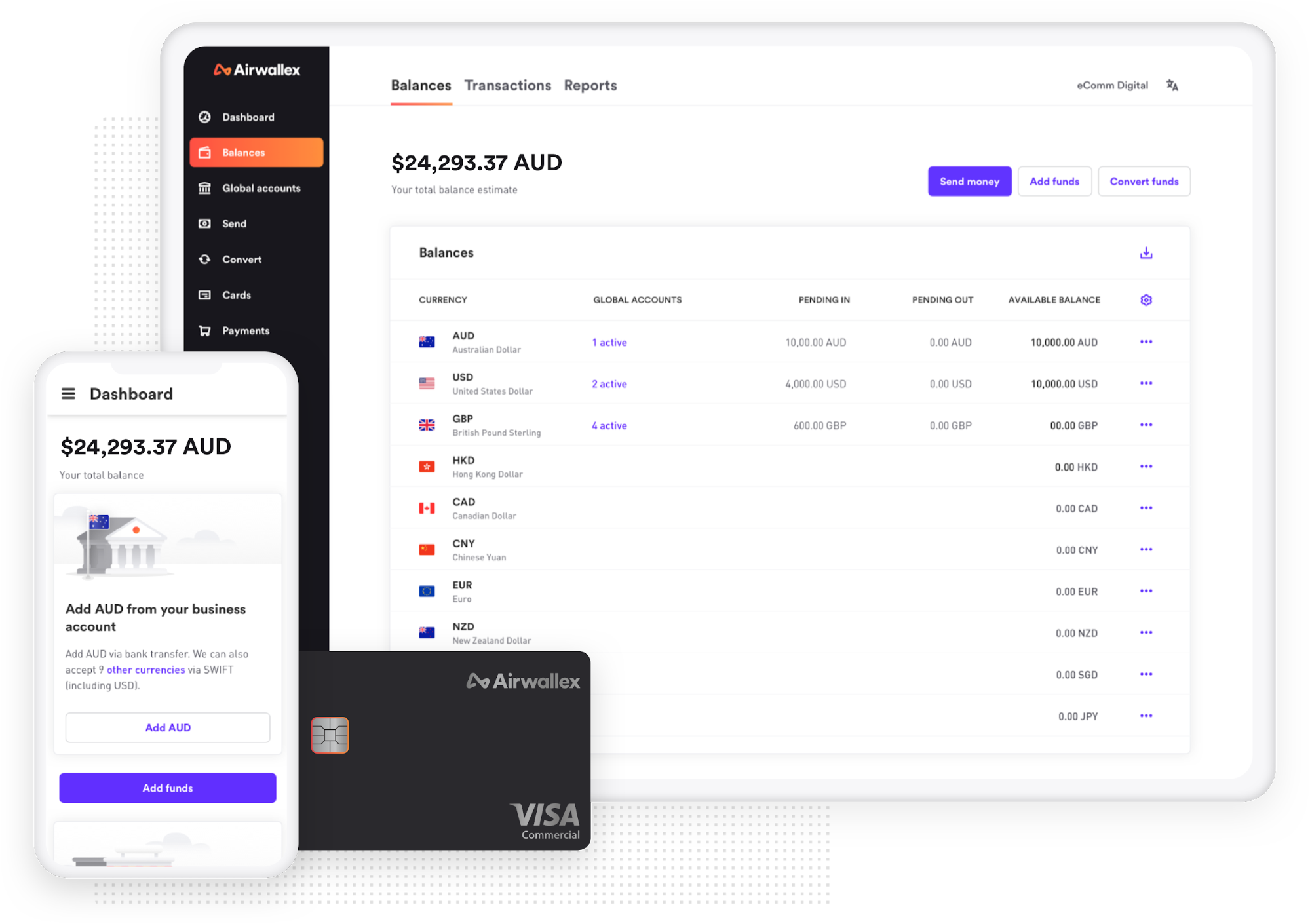

With Airwallex Global Accounts you’re not limited to one currency, either. In less than 5 minutes, you can easily setup 11 different Global Accounts, each for a different currency, and scale your market reach much further than a bank allows.

Say you’re looking to start selling on Amazon in the US. With your Global Account you can effectively create a US bank account, and start selling in the US immediately.

These global accounts also connect into payment gateways such as Stripe and PayPal, as well as buy now pay later platforms such as Afterpay and Klarna.

One centralised platform means you send and receive money directly to that account, without the need to convert to AUD. No high exchange rates, no waiting time on exchanges, just one simple transaction from your set currency account.

Boost your productivity

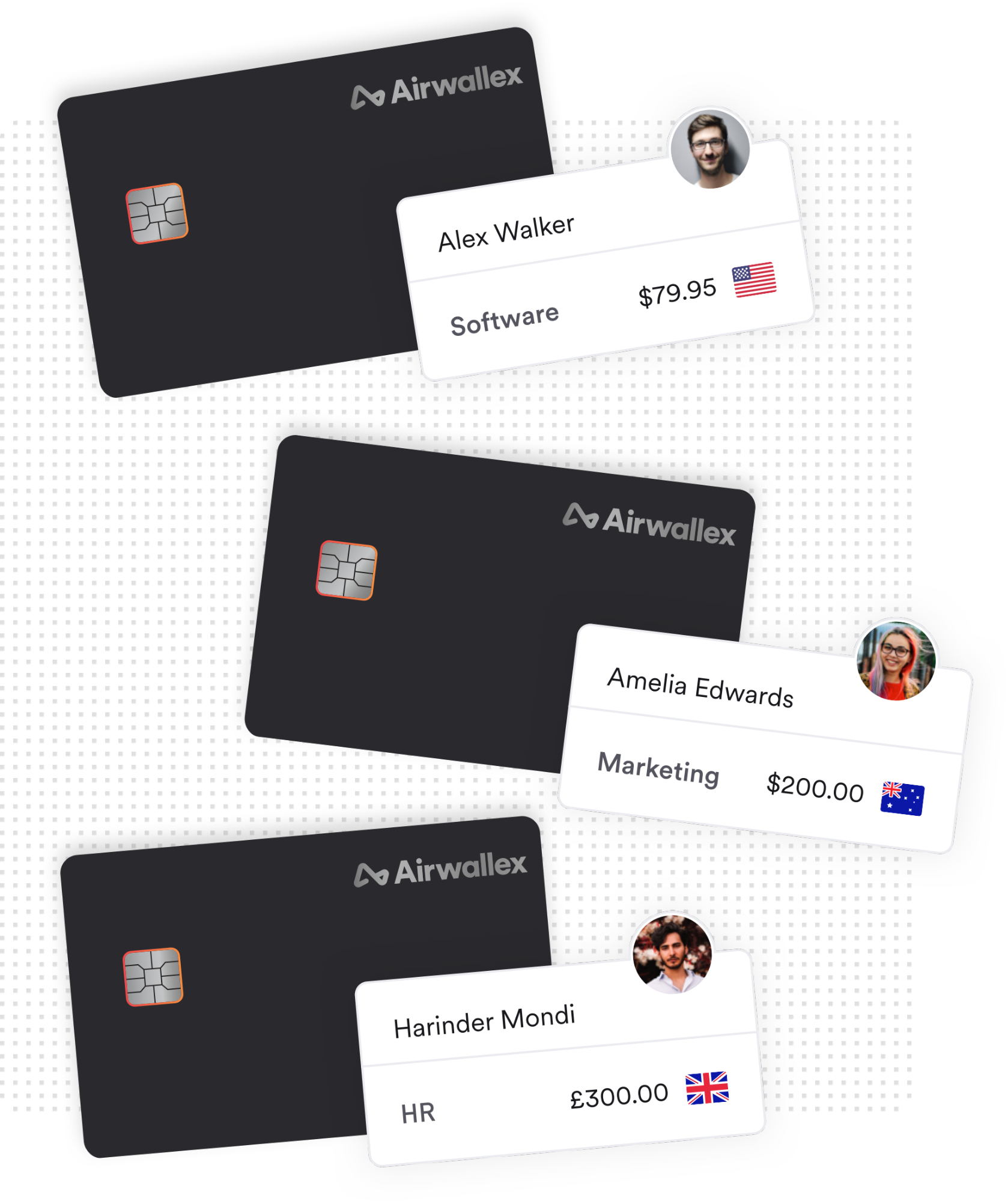

As global financial borders shrink, software capabilities continue to grow. A reasonably new development in the fintech space are virtual payment cards. These act in the same way debit or credit cards do, but without the need for a physical card. They’re ideal for managing spend online in a safe and controlled manner, and are a useful resource for regular international purchases. What’s more, these cards come with 0% international transaction fees, perfect for paying for any international software subscriptions (e.g. Klaviyo).

With Airwallex Cards you can create a virtual card in seconds, ready for your staff to use. No waiting around to receive a card from the bank, no messing around with security clearances. You can issue multi-use cards for regular transactions, or single-use virtual payment cards for one-off purchases.

As a manager, virtual payment cards provide greater oversight on spend, with flexible controls on daily, weekly, monthly or all-time spending limits on each card. And with a business looking to expand, this is ideal for tapping in to a remote global workforce.

Make your growth safer

By their nature, fintechs themselves are agile, forward-thinking businesses. They’re generally not tied down to any one location, and have the capacity to onboard and engage staff all over the world. This remote and flexible nature means that security is critical to their success.

With Airwallex, your funds are held securely in a ring-fenced account, and monitored using security systems and procedures that are based on the highest international standards, including PCI Level 1 compliance. Your data is stored and protected behind multiple layers of authentication, with two factor authentication enabled for added security.

Airwallex makes growing your business easy

We can streamline the way you reach new suppliers and markets, with an easier, quicker, and safer way to send and receive your money online.

We've partnered with Neto to help Australian businesses save even more with an exclusive offer:

Get your first $20,000 of foreign exchange free that’s 0% margin, $0 sign up and $0 ongoing monthly fees

Get in touch with Airwallex today to book a demo of our products, and see how this exciting suite of tools can drive your business growth.