Ecommerce and Retail • Neto

Buy now, pay later! It’s been a marketing hook used by the big retailers for decades and with good reason – customers love it. But when it comes to small businesses (and even not so small businesses), it tends to be off limits because of difficulties in implementation and management, not to mention the financial risks. That is, until now…

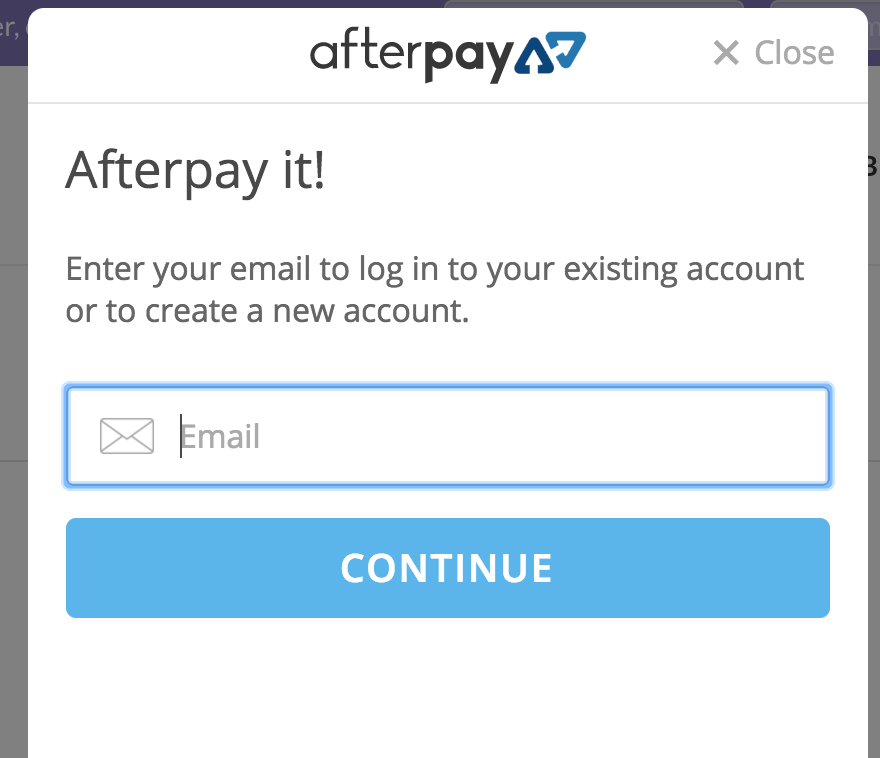

Enter digital moneylenders like Afterpay and zipPay. They provide a means for retailers of all sizes to offer customers a ‘buy now, pay later’ option for their purchases – with no risk to the retailer.

In just the 2017 year of trade, our Neto research showed an increase of 147% in transactions via a Buy Now Pay Later method. And while that still only accounts for 3.7% of total transactions it can only grow from there. The most popular industries were Pets & Animals (16%), Sports & Recreation (9%), Fashion (9%), Health & Beauty (5%) and Motor Parts (5%). Read More: 2017 State of Ecommerce Report.

What’s more, Australia Post’s Inside Australian Online Shopping 2018 Report has revealed a growing momentum in Buy Now Pay Later services with this payment method accounting for 7.7% of total online goods spend.

| Related Reading: The Complete Guide to Ecommerce Payments

And if you look at the stats from Afterpay themselves, they claim to process approximately 20% of online fashion purchases and 5% of total online retail purchases in the country.

Let’s delve into the features of the two leading Buy Now, Pay Later companies and see how it all works for both you and your customers.

This payment option allows the customer to purchase a product at the price they see there and then, but only pay for it later over four equal fortnightly instalments. There’s no line of credit and no additional fees or interest that needs to be paid, so long as the customer makes payments on time. Late payment fees only kick in after multiple SMS and email reminders. In fact, Afterpay only attributes 20% of their revenue to late payments, so something’s working well!

On average, Afterpay’s orders are around $150 and every order is approved through a fraud and repayment capability test. All customers start at a low purchase allowance, with limits only increasing after a positive repayment history (up to a maximum of $2,000).

Offering essentially the same type of service as Afterpay, zipPay allows customers to purchase now and pay later on a weekly, fortnightly or monthly basis, which is a nice level of flexibility for customers. zipPay is more like a digital wallet with an allowance of up to $1,000 and again, it’s interest free. Being a digital wallet, this means that for a purchase of $1,400, a customer can make a payment of $1,000 from their digital wallet and make up the remaining $400 with a debit card or cash.

There is a monthly fee of $6, but it’s waived if there is no account balance at the close of the month and customers must also pay off a minimum of $40 per month.

Neto has partnered with zipPay so, as with Afterpay, it will seamlessly integrate with your online store. In terms of what it will cost you as a merchant, you'll be charged a fee depending on your trading volume. zipPay also boasts fast settlement times, paying direct deposit into your bank account at 4pm every business day.

zipPay’s parent company, zip, also offer a premium Buy Now Pay Later solution, zipMoney, deemed by zip themselves to be ‘for life’s larger purchases’. Sign up for customers only takes about three minutes and credit limits vary from $1,000 to $20,000, but alas, this one does involve a credit check.

From a merchant perspective:

The more options you allow for payments, the more chance you have of closing the sale.

Not everyone has a credit card or a PayPal account, and for those Buy Now Pay Later converts, they’ll be seeking merchants who offer this option.

There are so many reasons why shoppers abandon their shopping cart at the last hurdle. ‘Buy now, pay later’ is just one more way to increase your conversion rate. For more ideas, read our recent article on ways to improve your ecommerce conversion rate.

Our 2017 State of Ecommerce Report determined that ecommerce retailers who implemented a Buy Now Pay Later option experienced up to a 26% increase in basket size. zipPay claims an increase of up to 80% in order value plus an overall increase of 30% in total sales. And don’t forget about the potential for repeat business - 86% of AfterPay customers have used the service more than once and zipPay merchants have experienced up to three times more repeat transactions.

With that payment flexibility, 80% of all basket sizes have increased.

The Buy Now Pay Later option is appealing to the 18-39 year old market. And whether you believe it’s the need for instant gratification or just savvy shoppers who prefer budgeting over buying on credit, we believe it’s the perfect way to tap into this market. And we suspect it will catch on in other demographic categories too.

As an ecommerce retailer, Buy Now Pay Later is now a viable option for your business to consider implementing, but more than that, it’s almost an essential option to be offering the savvy shopper. It will lead to increased conversions and increased customer satisfaction, so when you’re ready to take the next step, Neto can make it happen.

Start your Neto trial to enable Buy Now Pay Later on your store for free.